Angels and Moneybags (Different Investors and their Motivations)

We know that all investors are not the same and this is very true in the startup ecosystem. I have had the experience of dealing with a lot of co-investors - institutions, as well as individuals, and family offices. Let me focus on individual investors this time. If I have to categorise individual investors into buckets, I would primarily put them into two: Angels & MoneyBags.

Angel investors are the ones who play the role of an angel in the life of an entrepreneur. They step in when the startup is in need of help. Angels typically end up spending a considerable amount of time with startups they back. As a startup, there are lots of areas in which one needs external help. Angel investors co-exist with entrepreneurs and play the role of friend, philosopher and guide. They work with the founding team across areas and help with anything that requires attention from time to time as I highlighted above.

The primary belief of Angels is that they will make handsome returns on their investment if the business scales up to its intrinsic potential, and of course, the faster the better. Their objectives are totally aligned with the entrepreneur and founding teams. There does exist an area of difference between the investor and entrepreneur and that is the time horizon. An entrepreneur usually looks at his business as a lifelong commitment or at the least is much more long term than any financial investor would be. The business he is setting up is truly a ‘going concern’. This is an area that the entrepreneurs and the Angel investors have to manage and tread carefully to ensure there are no discords and that they remain focused on the long term goal of the business.

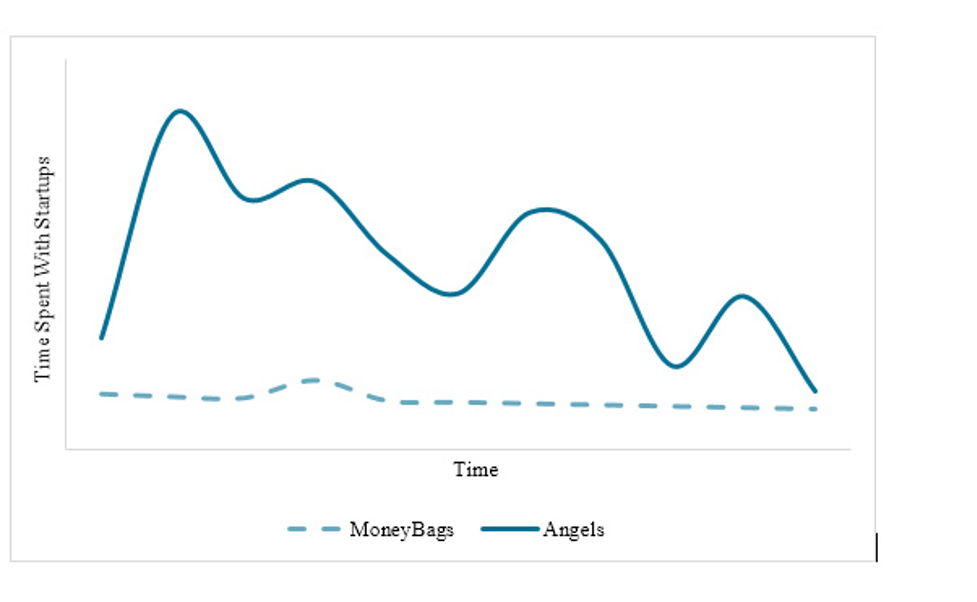

MoneyBags, on the other hand, are folks with a lot of money. Money, as we know, is the elixir of life for a startup. Moneybags can bring in much required capital to build out a business. This is where the similarity with Angel investors ends. The conversations between MoneyBags and entrepreneurs is about financial performance and valuation enhancing steps. MoneyBags spend minimal time with the firms they invest in, if any. The typical curve of time spent with startups is depicted :

The quality of MoneyBag capital is very different from that brought in by Angel investors. Before 2010, angels usually diluted 25% of the founders’ equity. This gradually came down to 20% around 2015. MoneyBag capital is typically impatient and seeks exit at some super high return in a very short time frame. This has been possible in some cases but the entire investment thesis of MoneyBags is around finding such investment avenues. While this is surely not a sustainable way to invest, it is the root of discord which can brew up between the startup and the investor. Intermediaries including angel networks, investment bankers, consultants and the like who are out there helping startups get funding at the best possible terms need to sensitise founders about this thorny issue.

Matching up a startup with the wrong kind of investor can have disastrous consequences for all parties involved. An entrepreneur seeking capital for short term survival with no interest in drawing upon the value add that investors can provide will be as disappointed if he gets an Angel investor to provide capital. The heartburn for the Angel investor will be as bad if not worse. Another entrepreneur who raises capital expecting inputs from investors but gets aboard MoneyBags who have little more to offer than capital will also face similar disastrous consequences

It is not whether Angels are better than MoneyBags or vice-versa. It is just that we need to be cognizant of the differences between these investors. This will enable all of us to focus on the most important task at hand, that of building a viable, sustainable and robust business in the real world.