Buoyant Markets = IPOs Growing = Easy Money -Making Opportunity?

To everyone’s surprise, markets have been in a bullish mood despite all the doom and gloom around us. In addition to the fatal health hazard COVID-19 has unleashed upon us, economies have been hit hard, businesses have had to shut down, and millions’ employment status has been endangered. For market participants, making money, at least on a mark to market basis, has been among the few joys we have experienced in more than 12 months.

As is the nature of markets, every secondary market bull run has many new primary market issuers offering their shares and taking their companies public. Of late, this trend has caught on significantly since private equity investors adopt the IPO route to exit their privately-held investments. It is also an opportunity for investors to participate in this listing process and seek to create wealth as these companies trade significantly above their offering prices. This seemingly simple construct seems to have come under some threat in recent times. Here are a few stars sprinkled, much-haloed IPOs that listed in global markets recently but have seen their market prices come off sharply from their highs:

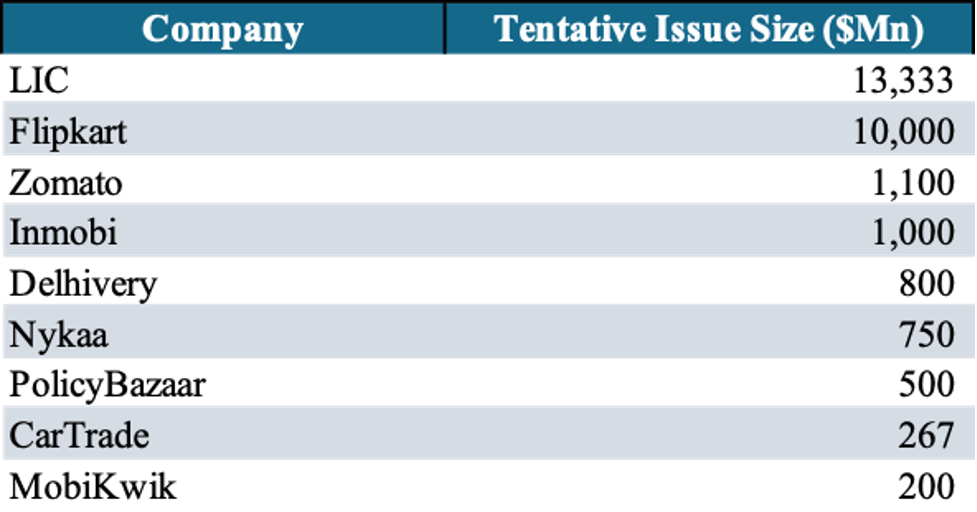

India and Indian markets are far more tightly linked to global capital flows than they have ever been in the past, and this is a one-way street as we globalise further. Let’s take a look at the much-awaited and exciting IPOs in the pipeline:

In addition to these, there are a host of others with near term listing plans in India or the USA, including Rebel Foods, Pine Labs, PhonePe, Grofers, Paytm, Byju’s, Ola, Droom, Freshworks, and a few others.

This comparison with global markets begs the obvious question: how are they likely to fare in the listed markets post IPO. It is anybody’s guess, but one thing is certain - it is no longer a no-brainer to make money by subscribing to these IPOs. We will have to pick wisely.