The Rise of The Mighty Fintech Industry

Boasting a market capitalization of US$ 2.9 trillion and GDP of ~US$2.6 trillion, India is one of the most important financial hubs in the world. The Indian financial industry has embraced technology and been at the forefront of innovation. Technological solutions, such as the UPI, backed by the National Payments Corporation of India (NPCI), government and banks, have seen unprecedented acceptance by all stakeholders. The United Payments Interface (UPI), which started in 2016, alone has enabled over 2.7 billion transactions worth over US$ 71 billion in March 2021, compared to ~US$ 9 billion worth of transactions through credit cards, which have been around for decades. With numerous examples like JAM (Jan Dhan, Aadhaar, Mobile) and India Stack, India has been the one of the most important proponents of “FinTech”. The term fintech signifies new and innovative financial technologies that are aimed at enhancing and widening the scope and delivery of financial services.

Fintech has disrupted the existing financial services industry by altering the way people deal with money - right from saving and borrowing to transacting and investing their assets. Elaborating on the same, Samant Sikka, Co-Founder of an Equanimity portfolio company, Sqrrl, shares, “The biggest mistake that one can make is to look at Fintech as a “theme”. Another narrow definition is the that Fintech is all that which is at the intersection of financial services and technology. That the businesses are going digital is a forgone conclusion and, in that reality, Fintech is the glue that binds the experience of consumers and businesses of businesses. We feel that over the coming years, no organisation will be able to survive without a fintech bone in their body. Sqrrl is focussed on the personal finance aspect of this opportunity. The fact that we have a razor-sharp focus on the Get rich population rather than Stay Rich population makes us stand out amongst the various players in the Industry. Our super specialised, super focussed and relevant offerings for the young Indians are targeted to help them improve their relationship with money!!”

Growth of the fintech

Fintech has come a long way from its origins in the last decade, making financial transactions digital, convenient, secure, and seamless. Followed by demonetization in 2016, an event which catapulted the industry into the foreground, the COVID-19 pandemic has further accelerated the adoption of fintech services and solidified its presence in our lives. According to a recent report by BCG, the Indian fintech sector has raised about US$10 billion from global investors over the last five years. According to Bain-IVCA’s India Venture Capital Report 2021, Fintech is the third most funded sector in India, behind Consumer and SaaS. Going ahead, the segment is expected to reach a valuation of about US$150-160 billion by 2025, a massive growth of US$100 billion from its current valuation of US$50-60 billion. With the humongous opportunity inherent in the industry, and the potential for value creation, it is safe to assume that the sector can attract investments worth US$20-25 billion dollars over the next five years.

Players in the fintech ecosystem

With the central role that technology has come to play in bolstering the financial ecosystem, several varieties of fintech companies have germinated in the industry, offering a wide range of services and products. Financial services consist of a number of functions, from payments and credit services to insurance and neobanking, and the 21st century financial ecosystem in India has dedicated fintech companies catering to all these varied requirements.

Payment providers: The Indian mindset towards payments has been fairly traditional with most people showing a proclivity for cash transactions. This bias is further amplified by widespread concerns related to the security of transacting digitally. The first real time payments system (IMPS) was launched in India in 2010 and then six years later, in 2016, Unified Payments Interface (UPI) was introduced. This acted as a catalyst for fintech adoption in India. In its first full financial year, 2017-18, UPI accounted for 9% of all retail digital transactions in volume terms and 1% in value terms. By February 2020, UPI’s share had crossed 50% in volume terms and 16% in value terms. The pandemic and physical distancing provided further tailwinds to UPI with digital payments accounting for nearly 25% of the value of all retail digital transactions, as of September 2020. Digital payments in India are growing at a steady clip, second only to China which is a world leader in the segment. Payment providers in India are now adopting the integrated financial services provider model where in addition to their core offering of payments, they are adding other services such as lending, personal finance, wealthtech, etc. One of the biggest sub-sectors, the payments segment hosts 5 out of the 11 fintech unicorns in India, namely Razorpay, PhonePe, PineLabs, BillDesk and Paytm.

Credit and lending service providers: Access to credit (or lack of) has always been a bane for India. The construct of the lending ecosystem is such that India is over banked at the top end of the pyramid and underbanked at the bottom end. As a result, the banking system is able to cater to only a fraction of the credit demand in the country. This can be attributed to the financial institutions’ inability to assess the credit worthiness of new-to-credit (NTC) and MSME borrowers. Digital lending fintechs are proactively leveraging technology solutions to create new underwriting models that can adequately assess the risk of NTC and MSME borrowers, thereby allowing them access to credit. Further, this also gives a boost to microfinance and financial inclusion in the country. According to a PWC report, India’s market for digital lending is poised to grow from US$110 billion in 2019 to US$350 billion in 2023. While no technology-enabled lender has reached unicorn status, this segment is likely to be targeted by the likes of Khatabook, OkCredit and Cred.

Wealthtech and Insurtech: While payment and lending providers have so far been the mainstay of India’s fintech landscape, new classes of fintech firms are now emerging including wealthtech and insurtech. Wealthtech firms are focused on leveraging technology to create customised digital solutions for end investors as well as the firms that service them. In doing so, they are not only helping investors create wealth but also enabling last mile access to financial services. On the other hand, insurtechs are leveraging advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) to provide innovative solutions in the insurance industry. It is expected that insurtechs will play a key role in improving insurance penetration in India which is currently very low at 3.69%, compared to a global average of 6.5%. Educating and empowering Indians with the ability to safeguard themselves and grow their wealth, this segment hosts 3 major unicorns, namely, Digit Insurance, PolicyBazaar and Zerodha.

Future of fintech

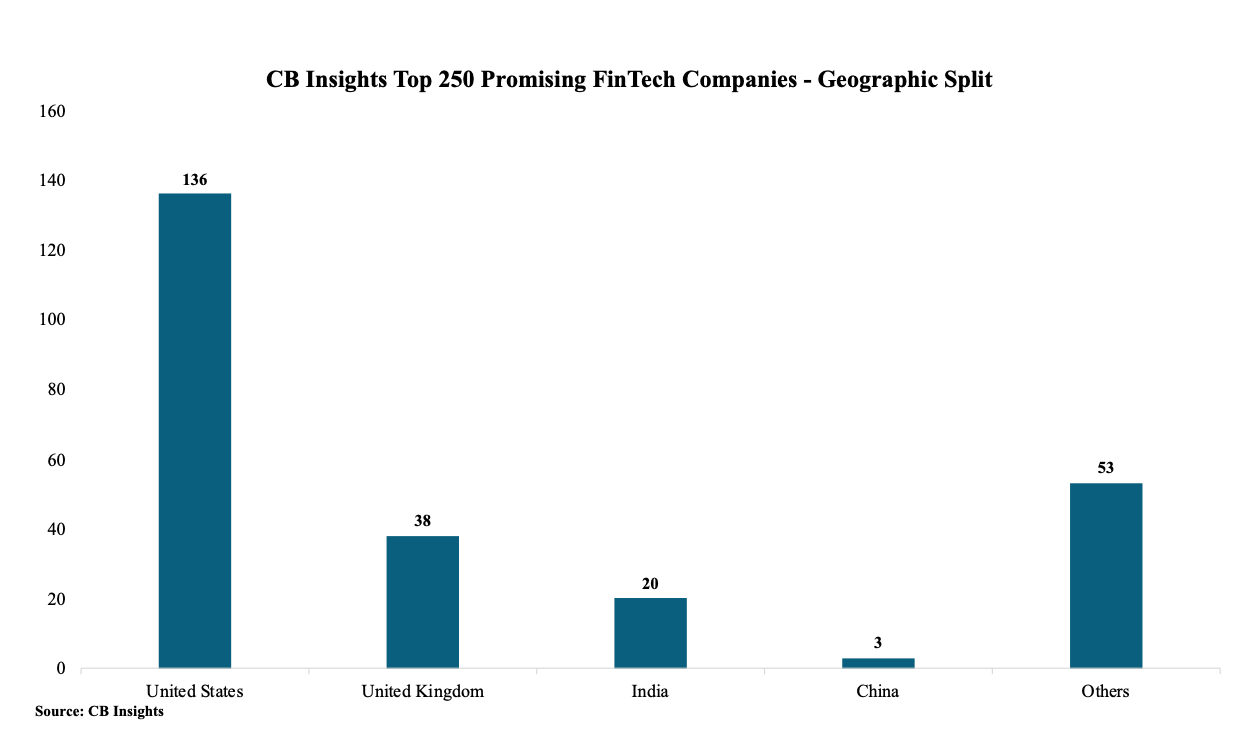

Given the tremendous potential depicted by the fintech industry, the future is bright for the Indian startups catering to the varied needs of discerning customers. Earlier this year, CB Insights published a list of the top 250 promising companies in fintech. While companies from the US dominated the list (136), India came in a worthy third place, with 20 companies. According to Invest India, the National Investment Promotion and Facilitation Agency of the country, the overall transaction value in the country’s fintech market is estimated to jump to US$140 billion in 2023. India is said to have overtaken China as Asia’s top fintech funding target market with investments of around US$286 million across 29 deals, as compared to China’s US$192.1 million across 29 deals in Q1 2019. Thus, it is imperative that fintech companies optimally leverage innovative technology to propel them towards the stratospheric rise that is visible on their roadmap.