What’s better: Start Up Growth or Profits?

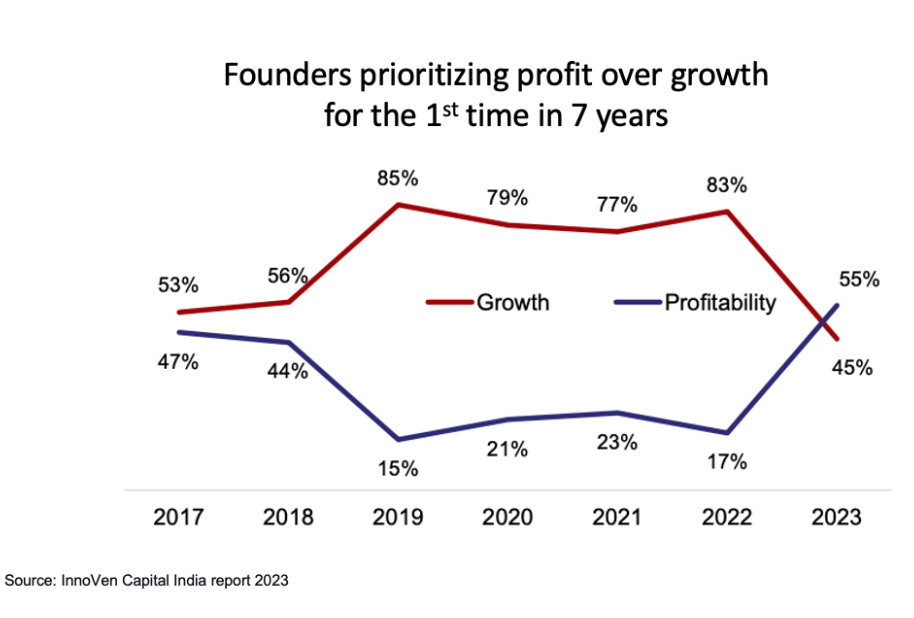

Within the startup ecosystem, there exists a quandary regarding the trade-off between growth and generating profits. However, the optimal solution lies in looking at these with a view to the business’s plans, objectives, and requirements at different stages is pertinent. While initial growth may involve more costs than revenue, profits cover operating costs more sustainably in the long run. The priorities between growth and profitability change depending on the stage of a startup’s life, from pre-seed to IPO. Each startup has its balance to strike between growth and profitability. For instance, in certain cases, the long-term return on equity (ROE) is nearly equal to the expense of equity capital. In such cases, actions that enhance profit margins would yield higher profits and, therefore, greater returns for investors than measures that promote growth. While in others, the ROE is substantially higher than the cost of equity capital. Hence, investors should prioritize approaches that hasten growth instead of those that lead to higher profits. Recently profitability has gained significant importance unlike prior years, when growth was a priority for startups. As seen in the survey undertaken via InnoVen Capital India.

The Startup Glide Path

Product-Market Fit: Once a company is ready with its proposition and plans, the next stage of focus is product-market fit (PMF). Only once PMF has been achieved can a startup decide whether to take the route of Growth First or Profits First. Critical indicators of PMF can include organic user growth through referrals and frequent repeat usage of the product by users. Arriving at PMF can be a cost-intensive exercise that requires external funding and goes towards a company’s cash burn, adding to the cost of “Growth”.

Another angle that affects the founders’ decision is factors beyond the team’s control that may affect its ability to scale. Market readiness, fundraising climate, and competition (current and future) are a few such factors that may cause a need for more funds which can come from a venture capitalist or through a shift to a sustainable growth plan. Either way, the objective early on is to ensure the startup remains afloat until such issues are circumvented.

Growth: Once PMF has been identified, the startup enters its Growth Phase. This phase is crucial for any startup to reach revenue milestones and prove the product’s viability. There is an inherent sense of urgency to achieve rapid growth, particularly for startups with a strong cash position and fast customer acquisition cost to lifetime value (CAC/ LTV) payback periods. A startup must invest resources, marketing expenses, and opex to capture market share rapidly. This impacts profitability.

Young companies can pursue growth and seize opportunities as they arise. They also prioritize revenue growth or profitability when necessary and cautiously capture market share by keeping costs low and becoming positive cash flow. It’s similar to a high-stakes poker game - you must make bold bets to win big, but you can’t bet if you’ve lost all your chips. Therefore, once you reach a mid-stage, the first rule is always to survive, build a category-defining business and achieve victory.

Sustainability & Profits: Once a suitable business model has been identified and customer base growth has been achieved, the company will require a different type of investor who prioritizes profitability over nominal growth. At this stage, they must decide whether to keep pushing for revenue growth at the expense of efficiency or focus on achieving sustainable profitability by optimizing margins. Investors seeking long-term returns will always prefer companies that prioritize profitability.

To summarise, while prioritizing profits may impede rapid growth and put the company at a disadvantage compared to competitors, it is becoming increasingly important for companies to plan for profitability. Achieving a critical mass of customers is still necessary to attain supply-side economics; profitability, in the long run, must be addressed. Ultimately, it’s essential to strike a balance between revenue and profits to ensure long-term sustainability and success.

As seen in the image above, Unicorns in India have been following the “Growth at all Costs’ strategy. Resulting in a positive Revenue CAGR (Compounded Aggregate growth between periods FY22 and FY21) while negative EBIDTA margins.

What Do Investors Want?

As seen in the Inc42 survey results above, investor preferences for startups have changed. The survey suggests Now, there is a greater emphasis on profitability (or a plan for profitability) rather than just growth, as investor demand to see higher operating revenues for late-stage startups, while lower burn rates for early-stage companies. This shift has led to discussions about a “return to business fundamentals” in the startup world, notably as tech stocks experienced a decline in early 2022. However, the full impact of this change has yet to be seen. Mid-stage businesses, such as those at Series B, C, and D, are already facing a reduced funding landscape and are struggling to reach their peak valuation. The slump can be primarily attributed to a turbulent year thus far, characterized by rising inflation and interest rates. Additionally, the situation has been made more complex due to unfavorable international signals, a downturn in the technology sector, and other macroeconomic influences.

In conclusion, it’s important to note that balancing growth and profitability is an ongoing process that evolves as the company matures and the economy changes. While it is impossible to predict the future with certainty, recent years have demonstrated how quickly the landscape can shift, and unexpected events can disrupt existing plans and priorities. The roles of venture capitalists and startups remain influential as they focus on transformation and improvement, regardless of macroeconomic conditions.