The World As We See It

Global Macro Scenario

The last quarter has seen positive policy moves from the US and China with the Fed’s first big rate cut in 4 years and the stimulus from China’s central bank bringing hope amidst global geopolitical concerns and uncertainties from the US election. During this time, the global economy, which grew consecutively for 8 months, slowed marginally, with the J.P. Morgan Global Composite Purchasing Manager’s Index (PMI) lower at 52 in September 2024 from 52.8 the month prior. This growth is still strong, driven by the service sector where activity rose for the 20th consecutive month, buoyed by a post-pandemic recovery in tourism and hospitality. In contrast, manufacturing production decreased for the first time since December 2023 due to weakening global demand, supply chain disruptions, and elevated energy costs.

Global Investment is expected to pick up as monetary policies begin to ease out. Global inflation is also expected to steadily moderate, supporting this ease in monetary policy. Inflation across advanced economies is expected to slow in 2024 and 2025 and it will remain higher in emerging markets. The oil market continues to experience volatility this quarter, driven by escalating geopolitical tensions. Brent crude prices averaged USD 74.02 per barrel in September 2024, down from USD 82.25 in June 2024.

In the US, mid-CY25, real disposable personal income (income after inflation and taxes) remained steady with a marginal increase of 0.2% in August 2024 from the previous month. Financial markets reflect this vigour, with the S&P 500 and Nasdaq posting September 2024 returns of 2.02% and 2.6%, respectively. By the end of 2QFY25, the Federal Reserve announced it would reduce the overnight federal funds rate to 4.75%-5%, finally ending a streak of seven meetings with rates held steady.

Across the Atlantic, the European Central Bank (ECB) further reduced the deposit rate to 3.5% this quarter, the previously reduced rate of 3.75% in June 2024. This move was prompted by slow economic growth and sluggish demand. Core inflation in the region dropped to 1.7% in June 2024, down from 2.2% in August 2024 where the aim would be to remain over 2% to ensure prices stability.

Turning to the East, China's exports grew a modest 2.4% in September 2024 over a year ago while imports rose 0.3% during the same period. The country’s foreign exchange reserves hit USD 3.316 trillion at the end of September 2024, up 0.86% from the previous month. China’s Consumer Price Index (CPI) rose by 0.4% year-on-year in September 2024, down from 0.6% in the previous month. The good news came in the form of aggressive monetary support steps for the first time since the Covid-19 pandemic such as interest rate cuts and a liquidity injection of 1 trillion yuan ($140 billion) to help support the markets. In Japan, GDP increased by 0.7 percent (q/q, seasonally adjusted) in 2QCY24, primarily due to a recovery in consumer spending. In August 2024, headline inflation in Tokyo reached 0.6 percent (m/m, seasonally adjusted), its highest level in nearly a year, driven by the withdrawal of energy subsidies and rising food prices.

In summary, the global macroeconomic scenario in 2QCY25 is one of slow, uneven recovery, with significant risks stemming from inflation, debt vulnerabilities, and geopolitical tensions. While there are pockets of resilience, particularly in services and green energy sectors, the broader picture is one of fragility and heightened uncertainty. Central banks will need to balance inflation control with growth support, while policymakers must address the longer-term challenges posed by geopolitical risks and climate change.

India Macro Scenario

India's economic landscape is painting a vibrant picture of resilience and growth this quarter, with the United Nations keeping the country's economic growth projections for 2024 steady at an impressive 6.9%. This optimistic outlook is fuelled by robust public investment and resilient private consumption, setting the stage for a dynamic year ahead in FY25. As we delve deeper into the economic indicators, a nuanced story of progress and challenges unfolds, revealing India's economic prowess and potential hurdles.

Q2FY25 ended moderately well, with the PMI softening by 1.0 percentage point to 56.5 in September 2024 compared to the exhilaration during the summer months. Export orders PMI was the lowest since March 2023, coupled with input prices growing at a comparatively faster rate causing weaker profit growth. This might have an impact on the companies’ hiring demand as the pace slowed throughout the quarter. Headline retail inflation eased to 3.65% in August 2024, steady from a one-year low of 3.60% in July, while September 2024 saw a sharp uptick to 5.49%.

In this complex economic landscape, the Reserve Bank of India (RBI) has been playing a pivotal role. The Monetary Policy Committee (MPC) has maintained the repo rate at 6.5% for nine consecutive meetings, prioritising price stability as a foundation for sustained growth.

Sector-specific performances paint a diverse picture of India's economic tapestry. The services industry, a cornerstone of India's economy, continued to show optimism with the HSBC India Services PMI at 57.7 in September 2024.

The stock market has kept the investors on their toes. Nifty50 and S&P BSE Sensex each rose gained 2.3% in September 2024 compared with a 2% rally seen in the S&P BSE Smallcap index and the S&P BSE Midcap index closing pretty much flat.

GST collections continue to serve as a significant barometer of economic activity, with July and August 2024 seeing gross collections reach INR 182 trillion and INR 175 trillion respectively, before settling in September 2024 at INR 173 trillion. The slowing growth rate in collections reflects the reduction in the manufacturing and services PMI, prompting economists to watch closely in the coming months.

Despite the challenges evident in some areas, the overall economic indicators suggest a continuing upward trend, positioning India as a key player in the global economic arena. The coming quarters promise to be both exciting and pivotal as the nation strives to balance growth with stability in its quest for economic prosperity.

Early Stage Ecosystem

The Indian early-stage startup ecosystem remains a vibrant hub of innovation and a powerful magnet for investor capital. Despite global economic uncertainties posing potential headwinds, 2QFY25 demonstrated the ecosystem's resilience and long-term potential.

YTDCY24 saw funds raised to the tune of USD 9.13 billion with an average deal value of USD 7.71 million. India witnessed a total of 1,184 investment rounds, ~84% of these in the early stage.

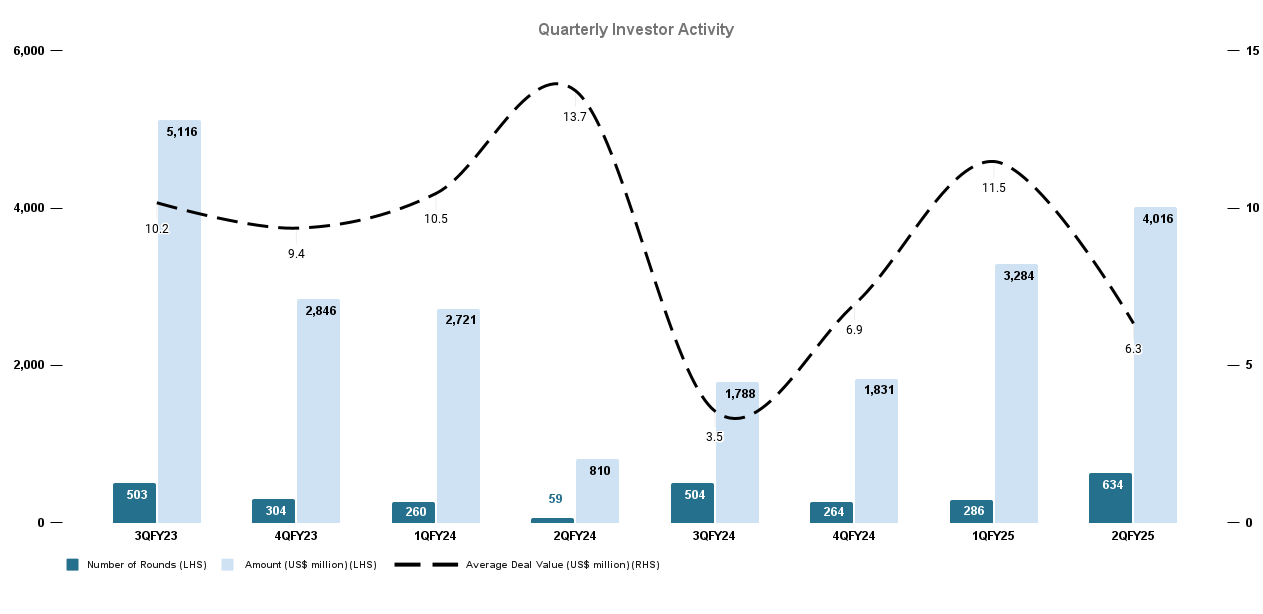

In 2QFY25, investment activity in the Indian startup ecosystem grew from the previous quarter. This quarter saw a modest increase from 1QFY25, with the total investment amount rising by 22.3% from USD 3.28 billion to USD 4.02 billion. More impressively, the number of rounds jumped by 122% from 286 to 634. The average deal value experienced a notable dip of 45%, from USD 11.5 million to USD 6.34 million. These figures demonstrate growing investor confidence in Indian startups and highlight the sustained momentum in the ecosystem, especially in the early stage. This strong performance sets a positive tone for the remainder of CY2024 and suggests a promising outlook for early-stage investments in India.

Quick commerce remains an investor favourite, racking up the bulk of the funding in the last quarter. This surge reflects evolving consumer behaviours and increased demand for rapid delivery services post-pandemic. Automobile repair emerged as the second-largest investment trend in 2QFY25 by value, driven by trends around insurance penetration as well as consistent increase in vehicle sales.

These trends highlight the Indian startup landscape's evolution, with investors focusing on capturing trends early. The robust investments in quick commerce and automobile repairs indicate a shift towards convenience from the consumer. The strong performance in 2QFY25, despite global economic challenges, underscores the resilience and adaptability of Indian entrepreneurs. As we move forward, sectors like EV mobility, AI, clean tech, health tech, and deep tech are expected to continue attracting significant investor interest, further diversifying and strengthening the Indian startup landscape.

At Equanimity, we remain highly optimistic about the potential of early-stage ventures within our portfolio. These companies are at the forefront of addressing critical market needs with innovative, cutting-edge solutions. Their progress and the overall dynamism of the Indian entrepreneurial landscape continue to reinforce our belief in the transformative power of startups.